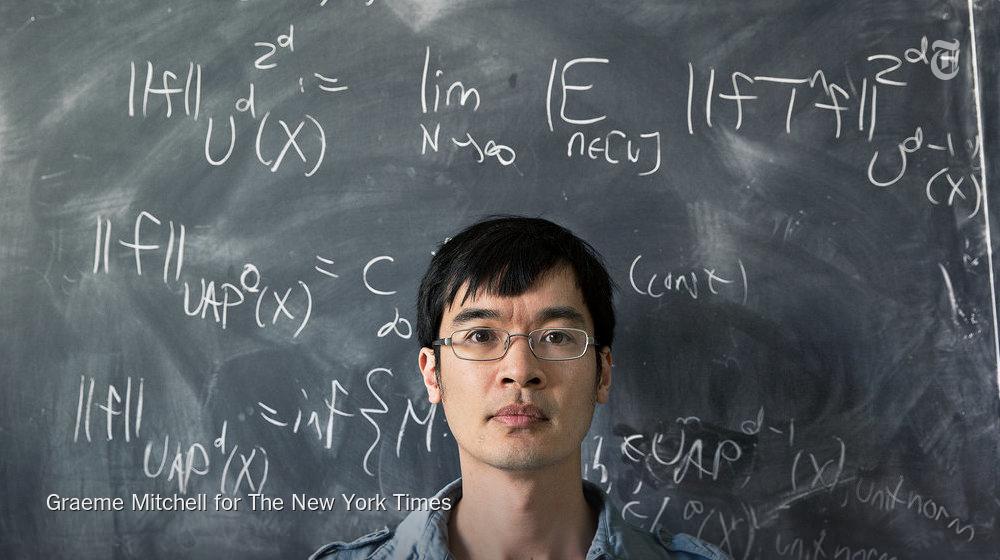

Shaw alum, Jeff Bezos, at his upstart Seattle-based online bookseller.Īt Amazon, Overdeck was Bezos' first shadow, following him everywhere he went. There he rose to managing director in charge of risk management but after nearly seven years left to work for another D.E. Shaw, the quant hedge fund of billionaire computer scientist David Shaw. At 16, Overdeck was studying at Stanford University, where he ultimately earned a degree in math and a master's in statistics, but he dropped out before getting his doctorate. His father was a mathematician at the National Security Agency, and his mother, who had a master's in math, managed a computer company. JOHN OVERDECK GREW UP IN THE well-to-do Maryland suburbs between Baltimore and Washington, D.C. Even in the sharp-elbowed trading culture, Two Sigma has proved exceptionally aggressive when it comes to protecting its methods and methodology, to the point where some employees who have tried to leave the nest have been sued, prosecuted-and jailed. Instead of competing with Goldman Sachs and George Soros, Two Sigma opens its checkbook to compete for top talent with Silicon Valley firms like Google and Facebook.īut those big packages-a twentysomething researcher can take home $550,000-come at a price. Most staffers are plucked straight out of the computer science, mathematics and engineering programs of MIT, Carnegie Mellon and Caltech. Its core hedge fund operation, run out of offices in Manhattan's SoHo district, now employs more than 800 researchers, computer programmers and statisticians, including 130 Ph.D.s and 6 International Math Olympiad winners. And it requires a never-ending supply of young math whizzes. The firm has expanded into reinsurance, venture capital and marketmaking. Putting all that money to work means stretching beyond its core competencies. (Overdeck and Siegel declined to comment to FORBES.)īut Two Sigma's breakneck pace has created a big challenge for its founders. So in a world where investors should effectively be shorting the likes of Warren Buffett in favor of faceless machines like IBM's Watson, where math formulas can create immense wealth, it is no surprise that Overdeck and Siegel are obsessive about avoiding publicity and keeping the firm's secrets under wraps. Must Read: The Little Black Book of Billionaire Secrets Said Siegel: "Eventually the time will come that no human investment manager will be able to beat the computer." And they join the ranks of the most successful of such traders, including James Simons (worth $14 billion), Ken Griffin (worth $7 billion) and David Shaw (worth $4.7 billion). They are card-carrying members of the growing tribe of quants who use big data and machine learning in an attempt to beat the market consistently. After winning a silver medal at the International Mathematical Olympiad in Poland at age 16, young Overdeck told the Washington Post that writing papers didn't seem fulfilling and instead he wanted to make the math "do something."ĭo something? How about build the fastest-growing big hedge fund on the planet and make multibillionaires out of its two founders? Overdeck, 45, and partner David Siegel, 54, run Two Sigma Investments, a little-known quantitative hedge fund firm that gathers seemingly random bits of information and tries to detect patterns that can be used to forecast the price direction of stocks and other securities. Like Tao, Overdeck is a math genius, but unlike his contest rival, he never wanted to be a professor.

In fact, it was the second time in its short history Overdeck, also a backer of the museum, had won the competition. He was beaten in the final round by a secretive Wall Street hedge fund manager named John Overdeck, who solved a problem involving infinite sequences and prime factorization. A professor at UCLA, Tao has won the Fields Medal, often described as the Nobel Prize of math, and the $3 million Breakthrough Prize.

In the end there was little surprise that the finals featured Terence Tao, 40, considered one of the greatest mathematicians of this generation. The annual event was hosted by the Museum of Mathematics, which was underwritten in 2012 by Google and the world's richest quantitative Wall Street traders, including Renaissance Technologies' billionaire founder, James Simons.

#Terry tao math series#

LAST YEAR SOME OF THE nation's greatest math minds gathered at Manhattan's elegant Tribeca Rooftop for stunning views, fancy food and wine-and a series of complex equations to determine who among them would be king of the geeks.

0 kommentar(er)

0 kommentar(er)